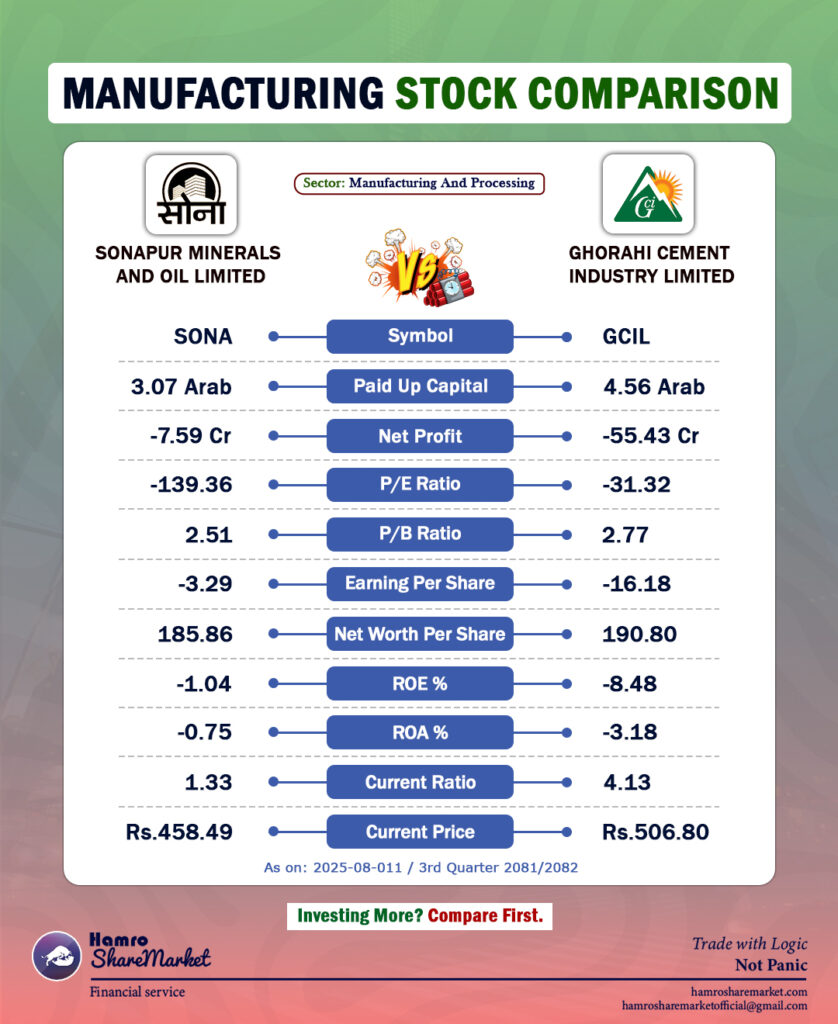

The cement and mineral sector is a vital part of Nepal’s manufacturing industry. Here we compare Sonapur Minerals & Oil Limited (SONA) with Ghorahi Cement Industry Limited (GCIL) based on their latest quarterly data.

📊Key Financial Metrics (Q3 FY 2081/82)

| Metric | SONA | GCIL |

|---|---|---|

| Paid-Up Capital | Rs. 3.07 Arab | Rs. 4.56 Arab |

| Net Profit | -Rs. 7.59 Cr | -Rs. 55.43 Cr |

| P/E Ratio | -139.36 | -31.32 |

| P/B Ratio | 2.51 | 2.77 |

| EPS | -Rs. 3.29 | -Rs. 16.18 |

| Net Worth Per Share | Rs. 185.86 | Rs. 190.80 |

| ROE % | -1.04% | -8.48% |

| ROA % | -0.75% | -3.18% |

| Current Ratio | 1.33 | 4.13 |

| Current Price | Rs. 458.49 | Rs. 506.80 |

Insights:

- Loss Position: Both companies posted losses, but GCIL’s are far larger.

- Liquidity Strength: GCIL holds higher short-term liquidity than SONA.

- Book Value: Both have similar net worth per share.

Takeaway: Neither company is currently profitable. Liquidity and loss levels should guide investment decisions here.